One World Lithium Accepts The Proposed 11 Hole Drill Program And One World Lithium’s Increased Property Interest In Its Salar Del Diablo Lithium Property, Baja California Norte, Mexico

One World Lithium Inc. (CSE-OWLI) (the “Company”)

______________________________________________________________________

VANCOUVER, B.C., AUGUST 08, 2018 – One World Lithium Inc. (CSE-OWLI) (“OWL”) (the “Company”) has accepted the Lithium Partnership’s (the “LP”) the final report summarising the Phase 2 pre drilling programs, which incorporates all the geochemical, geophysical and geological data necessary to select drill hole locations.

The Drilling Program

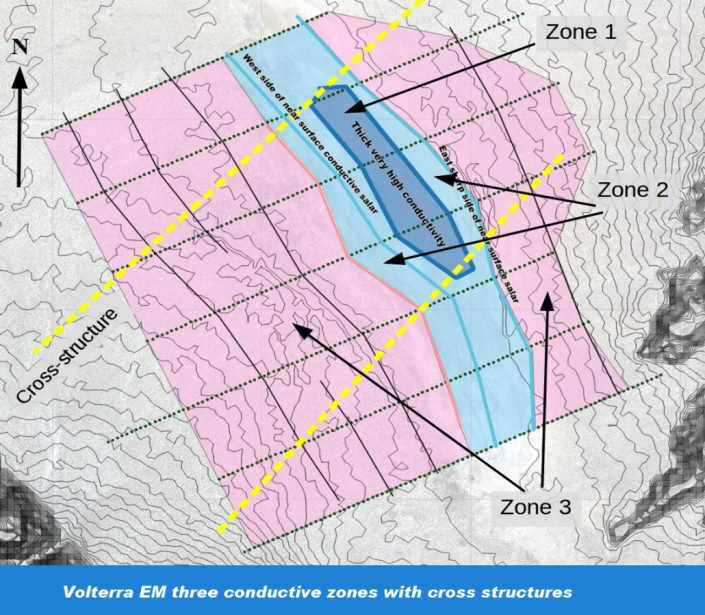

John Hiner, a licensed professional geologist and operator of the current programs through his company Jehcorp Inc. has selected 11 drill hole locations to test all three geophysical anomalous zones as well as two geochemical targets, which will require at least 4,000 meters of reverse circulation drilling. All the holes are placed near to interpreted geophysical and geochemical structures to test both the structural setting of the basin as well as the potential existence of aquifers that may contain lithium. The Company intends to commence drilling in the later part of October 2018.

Drill holes 1 and 2 will test geophysical zone 1. Drill holes 3,4, and 8 will test geophysical zone 2 and drill holes 5 and 6 in its southernly extensions. Drill holes 7 and 10 will test both geophysical zones 2 and 3. Holes 9 and 11 are sited to test the geochemical anomalies that are external to the geophysical survey footprint.

The drilling program includes permitting, site preparation, drilling and testing to discover potential aquifers, and then determine the aquifers thickness, permeability, porosity, initial flow rates, sustainable flow rates, sampling, lithium and related mineral grades.

The cost of drilling and testing is estimated at US$ 640,000.

Additional programs will include a gravity survey to establish basin configuration, a time domain electromagnetic surveys to close the open ended conductive zones 2 and 3; a pre-feasibility study, and a second pre drilling program to evaluate the remaining 80% of the Property, which includes the southern most third of the property.

As previously reported on April 11, 2018, the geochemical lithium surface anomaly is 160 square kilometers. Also, as previously reported on July 03, and July 17, 2018 the summary of the Geophysical report noted there are three conductive zones that extend over sixty kilometers with two zones open ended as they extend beyond the survey grid. Zone One covers six square kilometers and may be more than 100 meters thick. Syd Visser, President of SJ Geophysics noted “The Salar del Diablo was considerably more conductive than expected. The conductive layers could represent saline brines which may contain elevated concentrations of lithium.”

Geological Summary

A geological map has not been completed. However, evaluation of satellite data, geophysical data, known tufa mounds and outcrops indicate significant intra basin structures exist that include faults in bedrock outcrop outside the basin that trend into the Salar.

There are north-south active faults, which are translational strain responses to the opening of the Gulf (of California) as well as linears that are likely cross faulting throughout the basin and adjacent bedrock outcrops.

There are two evident features:

1.) the geophysical zone 1 appears to be constrained at the north and south ends of the survey area by a significant increase in cross faulting; and

2.) the cross faulting appears to dominate the east side of the basin and bedrock complex. These features suggest the conditions may exist to concentrate brines.

The Company’s Property Interest

On completion of the Phase 2 pre drilling programs as well as payment of concession fees estimated at US$ 130,000 USD the Company will own an undivided 60% interest in the property. The Company has paid US$ 50,000 to the LP and is in the process of issuing 200,000 common shares in total to the LP Partners. On completion of the phase 3 programs and paying concession fees, the Company will earn an additional 20% undivided interest for a total of an undivided 80% interest in the property. The Company, upon the delivery of a bankable feasibility study, will have an additional option to purchase a further 10% property interest for a payment related to the discounted net present value of the project. The LP is in the process of assigning its interest to Energy Metals Discovery Group LLC.

-END-

About One World Lithium Inc.

One World Lithium Inc. (“OWL”) an exploration Company is focused on exploring and developing lithium projects of merit. It currently has an option to acquire up to a 90% working interest in the 75,400 hectares or 754 square kilometers) Salar Del Diablo Property located in Baja California Notre, Mexico.

On behalf of the Board of Directors of One World Lithium Inc.,

“Douglas Fulcher”

Douglas Fulcher, President and CEO

For further information, please contact:

Darren@oneworldlithium.com and/or visit www.oneworldlithium.com

Forward-Looking Information: This press release may include forward looking information within the meaning of Canadian securities legislation concerning the business of the OWL. Forward looking information is based on certain key expectations and assumptions made by the management of the OWL, including the intention of OWL to proceed with the advancement of the Property and intentions regarding the proposed exploration and drill programs. Although OWL believes that the expectations and assumptions on which such forward looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because OWL can give no assurance that they will prove to be correct. Forward looking statements contained in this press release are made as of the date of this press release. OWL disclaims any intent or obligation to update publically any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from the those anticipated in such statements, important factors that could cause actual results to differ materially from the company’s expectations include: (I) inability of OWL to execute its business plan and raise the required financing and (II) risks and market fluctuations common to the mining industry and lithium sector in particular. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, some of which are beyond the control of the OWL. The reader is cautioned not to place undue reliance on any forward-looking information contained in this press release.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release